that the Three Black Crows Candlestick pattern : Key Takeaways: Traders should take the help of volume and technical indicators for confirming the formation of this candlestick pattern.īelow is an example of the daily chart of Phillips Carbon Black Ltd. Traders can take a short position after the bearish candlestick pattern is formed. It is formed when the sellers exert bearish forces and make the prices fall for three consecutive days. Three Crows pattern is multiple candlestick patterns that is used for predicting reversal to the downtrend from the uptrend. This candlestick pattern consists of three candlesticks: a large bullish candlestick, a small-bodied candle, and a bearish candlestick.Įvening Star patterns appear at the top of the uptrend and signals that the uptrend is going to reverse to a downtrendīelow is an example of the Evening Star pattern is formed in the Nifty 50 chart below: 5. The Evening Star:Īn Evening Star is a candlestick pattern that is used by traders for analyzing when the uptrend is going to reverse to a downtrend.

#Candlestick patterns how to

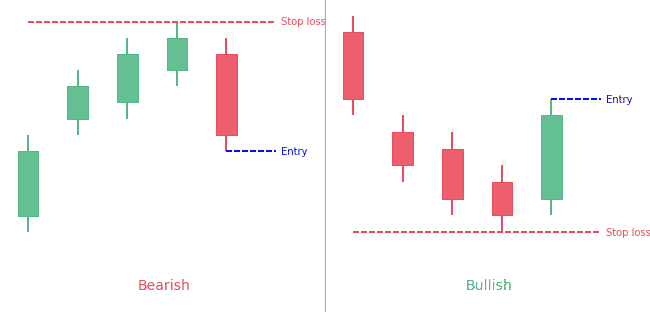

Learn how to trade with bearish and bullish engulfing patternsīelow is an example of the Bearish Engulfing pattern as shown in the daily chart of Reliance Industries: 4. The pattern is formed by two candles with the second bearish candle engulfing the ‘body’ of the previous green candle. This pattern triggers a reversal of the ongoing uptrend as sellers enter the market and make the prices fall. The bearish engulfing pattern is the bearish reversal pattern which signals a reversal of the uptrend and indicates a fall in prices due to the selling pressure exerted by the sellers when it appears at the top of an uptrend. This candlestick pattern are made of two candlesticks, the first being a bullish candlestick and the second one is a bearish candlestick.Īs the prices rise, this pattern becomes important for the reversal to the downside.īelow is an example of the Dark Cloud Cover in the daily chart of Sun Pharmaceutical Industries Ltd. Dark Cloud Cover:ĭark Cloud Cover is a bearish reversal candlestick pattern formed at the end of an uptrend and indicating weakness in the uptrend. This pattern helps the traders to square their buy position and enter a short position.īelow is an example of the formation of the Hanging Man on the Daily chart of Nifty 50 below: 2. The lower shadow should be twice the length of its body and there is no upper shadow. It has a small real body which indicates a small distance between the opening and closing price.

0 kommentar(er)

0 kommentar(er)